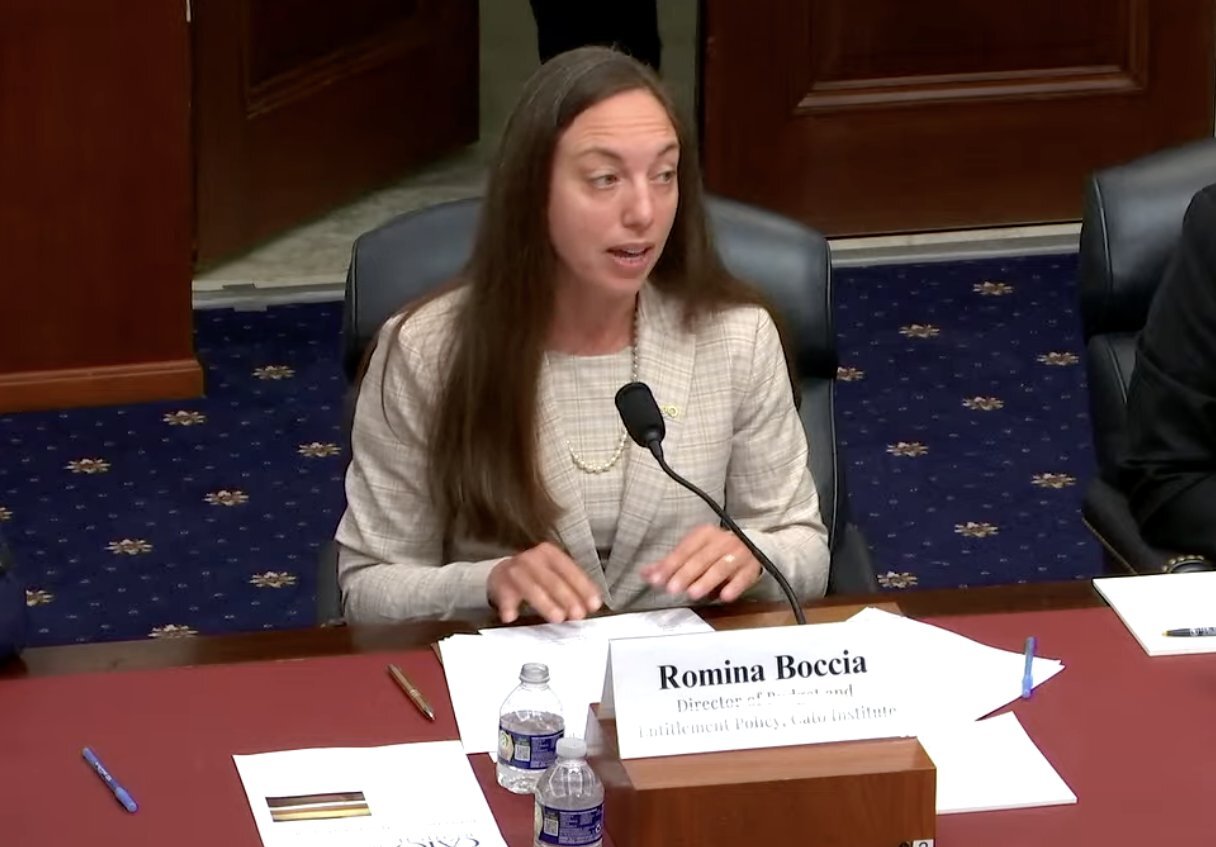

Below are interactions with members of the US House Committee on the Budget following my testimony on December 11, 2024. You can find my oral remarks here and watch the full hearing here (my remarks: 20:15–25:55). These discussions delve deeper into the fiscal challenges and potential solutions discussed during the hearing, offering a closer look at key concerns raised by lawmakers.

- Rep. Tom McClintock (R‑CA) – “The Ranking Member noted the catastrophic scourge of COVID on the world but failed to mention the $3.7 million in NIH grants that funded the Wuhan Institute of Virology, the most likely origin of COVID. That was just a fraction of the hundreds of billions that are spent on grants to NGOs or projects that rob one community to pay for local projects in another. It seems to me that this committee ought to be looking into every one of these ludicrous expenditures. What’s your view?”

- My response (52:19–53:10) – “Yes, I think we need to look under the hood of the federal budget and the numerous programs—thousands, in fact— that Congress continues to fund without taking a close look at them. As you mentioned, there are many expired or unauthorized programs that Congress should review, and we may find there’s a tremendous amount of duplication, inefficiency, and waste that the federal government could cut. Thank you for bringing to light particular examples of this, but I also need to highlight that just addressing discretionary spending and those grant programs is not going to stabilize our spending trajectory or debt, as they are primarily driven by healthcare costs, interest on debt, and pensions.”

- Rep. Tom McClintock – “Shouldn’t we put strict work requirements on all entitlement programs for able-bodied adults?”

- My response (53:25–53:41) – “Work requirements can work for Medicaid, food stamps, and other means-tested benefits. That is a good idea that Congress should take into account for reconciliation next year to make sure tax cuts are offset.”

- Rep. Tom McClintock – “Since 1836, House rules prohibit any appropriation unless authorized by law. Yet, we suspend that rule every year and shovel half a trillion dollars at these agencies whose authorizations expired years ago. Shouldn’t we enforce that existing rule and require an agency-by-agency review of these expired federal programs?”

- My response (54:16–54:44) – “Yes! Congress has suspended too many good rules, such as the PAYGO rule, which I fear it may suspend again next year. Also, Congress has suspended the debt limit, which will return with a vengeance in January 2025. Congress should adopt a credible fiscal plan to stabilize our debt before raising the debt limit again, and, certainly, they shouldn’t suspend it, which is basically a borrow-as-much-as-you-need waiver.”

- Rep. Glenn Grothman (R‑WI) – “Since the last tax cuts, what percentage of our revenue is coming from ‘the wealthy’?”

- My response (1:27:25–1:28:28) – “The top 10 percent of income earners pay about 70 percent of our income tax burden. We already tax the wealthy very heavily. In fact, the United States has one of the most progressive tax systems in the world. The countries that I mentioned earlier in my testimony—Germany, Sweden, and Switzerland—and most European countries tax their middle-class taxpayers at much higher rates, often through value-added tax (VAT). […] If we’re talking about relying solely on revenue increases to close our fiscal gap, we need to be honest with the American people: this would require steep tax hikes on the middle class.”

- Rep. Buddy Carter (R‑GA) – “How would something like a debt brake work in the United States?”

- My response (1:41:11–1:42:33) – “Debt brakes enjoy popular support because they tackle the debt, which is something that the entire public can get behind, regardless of their political affiliations. In Germany, the debt brake takes the form of a deficit limit; in Switzerland, it’s a spending cap; and in Sweden, it’s a blend of both. Importantly, these debt brakes don’t try to achieve balance immediately, which would result in an economic calamity, but over time. They lock in fiscal commitment with popular support and bipartisan backing. Additionally, the process includes oversight by an independent council to hold lawmakers accountable. However, I must emphasize that you cannot just adopt a BBA and hope that the budget will take care of itself. Congress will still need to do the tough work of identifying how we can get on that path to balance, with the BBA acting as a commitment device.”

- Rep. Ron Estes (R‑KS) – “Could you elaborate on how the Executive Action Cost Transparency Act would help Congress better control executive spending?”

- My response (1:53:33–1:54:37) – “At the Cato Institute, we aggregated the cost of emergency spending over the past 30 years, and we were shocked by what we found: we’ve spent over $14 trillion in that period by designating expenditures as emergencies. Notably, we couldn’t find a government report that details those figures. Emergency spending occurs outside the regular budget process and isn’t subject to budget caps or rules like PAYGO. That’s where the lack of transparency and accountability begins. We need the Congressional Budget Office, the Government Accountability Office, or both, to aggregate, detail, and report to Congress on the cost of emergencies—both those authorized by Congress and those declared by the Executive Branch. Currently, there is a lack of transparency. The Biden administration, for example, has refused to cooperate with Congress in reporting on Executive emergency spending, leaving us without a clear understanding of the cost of these actions.”

- Rep. Bob Good (R‑VA) – “As you know, the Social Security Fairness Act passed the House a month ago despite its $200 billion cost to taxpayers over the next decade and its acceleration of the insolvency of the Social Security trust fund. What does this say about the willingness of House Republicans to address entitlement reform, our debt and deficits, and our long-term fiscal viability?”

- My response (2:05:55–2:06:59) – “It sends a very bad signal that Congress has not yet fully grasped the severity of the debt crisis and the threat it poses for our nation. It also shows that Congress is still in the pockets of special interests. The Social Security (Un)Fairness Act would benefit state and local government unions and their members, a very small but extremely powerful special interest group. It is because they can gain concentrated benefits and diffuse the costs among general public. This bill would also accelerate the Social Security trust fund’s insolvency by six months. So, while Congress claims it won’t cut Social Security benefits, by voting for this act, it has actually accelerated the trust fund insolvency.”

- Rep. Bob Good – “The Republican leadership is considering passing a $150 billion disaster supplemental. Why would we borrow and give the Biden administration or FEMA these funds? Is there any less efficient way to help people than through the federal government?”

- My response (2:08:16–2:08:41) – “We have a real moral hazard problem with our federal disaster assistance. We need significant reforms so American taxpayers aren’t on the hook for paying the damages that primarily benefit the wealthy. If Congress wants to pass a disaster relief bill, it should pay for it now or later instead of adding to our deficit and debt.

- Rep. Chip Roy (R‑TX), Rapid Questions (2:14:25–2:21:13):

Q: “Do you think the Inflation Reduction Act (IRA) is corporate welfare?”

A: “Yes, Congress should repeal it.“Q: “Is it your position that the TCJA, if extended, will pay for itself?”

A: “No.“Q: “Would you agree that the TCJA extensions should be offset by additional measures such as spending cuts and revenue increases generated through economic growth?”

A: “Yes, we need both.“Q: “In recent memory, have you seen any proposal from either side of the aisle to seriously address mandatory spending?”

A: “No.”

- Rep. Lloyd Doggett (D‑TX) – “Do you believe that the extension of the Trump tax cuts should be offset?”

- My response (2:22:29–2:22:43) – “We’ll need to pay for the extensions, especially for the individual tax cuts. The pro-growth side of the tax cuts is a different matter, but if we extend the whole package, it should be paid for. We should also take this opportunity to reduce deficits and stabilize the debt.”

- Rep. Chuck Edwards (R‑NC) – “How can we hold federal agencies more accountable for spending?”

- My response (2:44:56–2:45:23) – “Congress needs to work with agencies throughout the year, not just during hearings. It should heed the recommendations of the Government Accountability Office, which does the heavy lifting of identifying accountability and transparency issues and recommending necessary system upgrades. Also, Congress should demand more reporting, especially on emergency spending, which is still very much obscure.”

- Rep. Rudy Yakim (R‑IN) – “At what point do you believe that our debt will become insurmountable?”

- My response (2:50:38–2:51:18) – “Our debt is already an excessive burden on the American economy. Nobody knows when it becomes insurmountable, although we have projections from Penn Wharton suggesting that our fiscal space will run out in about 15 years. However, this is subject to factors like investor sentiment and the performance of other currencies, and we should not wait to find out where that threshold lies.”

- Rep. Rudy Yakim – “What would the impact be on our economy if and when that happens?”

- My response (2:51:26–2:51:54) – “If we suffered a severe fiscal crisis, where investors lost confidence in the US government’s willingness or ability to service the debt, we would suffer severe increases in interest rates and the potential of hyperinflation. While scenarios like those in Venezuela or Argentina may seem far-fetched, they are not beyond the realm of possibility if we continue on this reckless and unsustainable trajectory.”

Note: The questions and responses have been edited for clarity and readability and should not be considered direct quotes.